Individuals that are considering filing bankruptcy to help them eliminate their debt, often consider filing Chapter 7 bankruptcy. Chapter 7 bankruptcy allows individuals to get rid of their debt, so they don’t have to pay their creditors.

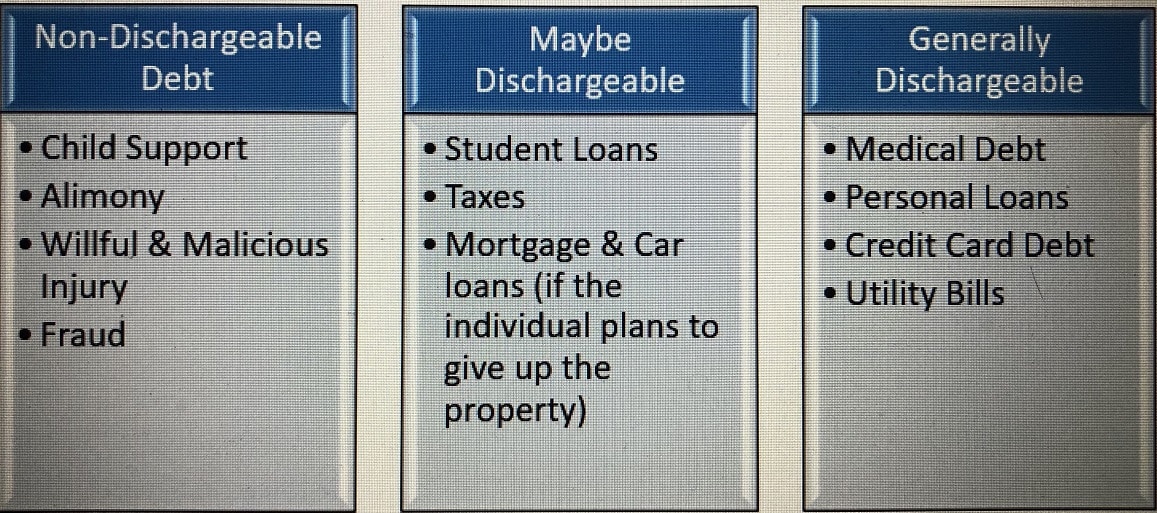

Individuals often assume that filing bankruptcy will eliminate all their debts. Unfortunately, not all debts are dischargeable under Chapter 7 bankruptcy. Most people, however, have debts that can be discharged under Chapter 7 however, individuals should be aware of debts that may not be discharged. This article will discuss what debts are and aren’t dischargeable to ensure that Chapter 7 bankruptcy is the right choice for individuals considering bankruptcy.

Chapter 7 Discharge

The main goal in a Chapter 7 bankruptcy is to get a discharge. A bankruptcy discharge eliminates the filer's responsibility to pay back the debts they owe. When an individual gets a discharge, it prevents creditors from initiating any collection actions against them.

In most cases, individuals that file Chapter 7 bankruptcy receive their discharge notice at the end of their Chapter 7 bankruptcy case. Typically, the notice of discharge is mailed to the individual's home 60 days after the first meeting of creditors. In other words, about four months after an individual files Chapter 7.

The discharge notice is an order signed by the judge putting creditors on notice that they can no longer pursue the individual for debts they owe.

Unsecured Debt in Bankruptcy

Generally, unsecured debts are discharged in bankruptcy. Unsecured debts are debts that are not attached to collateral. A debt is unsecured if the individual didn’t agree that the creditor could take property if they didn’t make their payments. Some examples of unsecured debts are credit card debts, medical bills, utility bills, back rent, government benefit over-payments, and personal loans.

Secured Debt in Bankruptcy

Secured debts in bankruptcy are debts that are secured by collateral. Secured debts are treated differently than unsecured debts in Chapter 7 bankruptcy. Secured debts typically may be dischargeable but how they become dischargeable is different. Some examples of secured debts are mortgages, car loans, and tax debt. Individuals often sign agreements that allow creditors to put a lien on their property and take the property if they don’t make their payments. This is a secured debt because it is secured against the piece of property and the creditor can relinquish the property if payments are not made.

What Happens to Secured debt in Bankruptcy

Individuals can get rid of their secured debt in bankruptcy. However, to get rid of the debt, they will need to give up their property. The creditor has the right to keep a lien on a piece of property until the debt is paid. For example, if an individual can’t afford their car payment, they can give the vehicle up in the bankruptcy and no longer be liable for the debt.

Individuals struggling financially can often benefit from giving up their secured property in bankruptcy. To do this, the individual will simply, inform the Bankruptcy Court on their bankruptcy forms that they want to surrender the vehicle or piece of property. Generally, the creditor will pick up the property so, the debtor doesn’t have to do anything. The only requirement the debtor must comply with is providing the creditor with the necessary information they need to pick up the property.

Sometimes, creditors won’t take the property back even if it is a secured debt. If the item is small or has an insignificant value, the creditor may allow the individual to keep the property.

In some cases, creditors may forget to file a security interest in the property thus, the individual won’t have to give the vehicle back. An example of this would be if a mortgage company never recorded the lien on a piece of property. Since the lien was never recorded, the debt would technically be unsecured. This is extremely rare and usually doesn’t happen. Most lenders immediately file their security interest to ensure they are paid.

Unsecured Debts That Are Not Dischargeable in Bankruptcy

Unfortunately, not all unsecured debt is dischargeable in bankruptcy. There are certain types of unsecured debts that individuals who file bankruptcy will remain liable for.

Debt Incurred by Fraud

Individuals who take out debt by using methods of fraud or false pretenses are not able to get the debt discharged. An example of this is if an individual takes out a loan and has no intention of paying the loan back. Other examples include lying on credit card applications such as stating a much higher income to qualify for more money. Individuals who have committed fraud should not consider bankruptcy as an option. Bankruptcy fraud is a federal crime and, in some cases, may lead to prison time.

Student Loan

Although, a student loan is an unsecured loan the Bankruptcy Code generally, does not allow student loans to be discharged in a Chapter 7 bankruptcy. In rare circumstances a debtor may be able to discharge a student loan in bankruptcy if they can show:

To qualify for student loan discharge, it is extremely costly and requires a very specific set of circumstances. Most individuals are not able to discharge their student loans through the bankruptcy process.

Large Purchases Before Bankruptcy

The Bankruptcy Code does not allow individuals to purchase luxury items on credit cards and then file bankruptcy. To eliminate this issue the Bankruptcy Code has set out provisions regarding how much an individual can charge on their cards before filing bankruptcy. Debts incurred within 90 days of filing a bankruptcy petition are presumed non-dischargeable. Moreover, cash advances taken out of more than $1,000 within 70 days of a bankruptcy filing are non-dischargeable. Individuals who have incurred such debt right before filing should wait to file their bankruptcy petition.

Tax Debt

To discharge tax debt in a Chapter 7 bankruptcy certain circumstances must be met. Tax debt is dischargeable if:

Determining whether an individual's tax debt is dischargeable in bankruptcy can be confusing. The Bankruptcy Code provides complex rules with regards to whether a tax debt is dischargeable. Individuals must seek out an experienced attorney to help them determine if their tax debt can be eliminated through Chapter 7.

Lawsuit Judgments

Individuals who are sued due to willful or malicious injury to another person or property are not able to discharge their debts. This also includes debts for death or personal injury if the filer was drinking while driving or under the influence of any other substances.

Alimony & Child Support

Alimony and child support payments are not dischargeable in a Chapter 7 bankruptcy. Thus, individuals who are behind on these court-ordered payments must continue paying their arrears.

Individuals considering bankruptcy may want to speak with a bankruptcy lawyer to help them determine if their debts may be discharged in a Chapter 7 bankruptcy. Individuals who have debts that can’t be discharged in a Chapter 7 bankruptcy may be able to file a Chapter 13 bankruptcy to help them repay their debts over a 3-5-year repayment plan. Many law firms can review an individual's debts and immediately determine whether Chapter 7 bankruptcy is the best option for eliminating their debt.